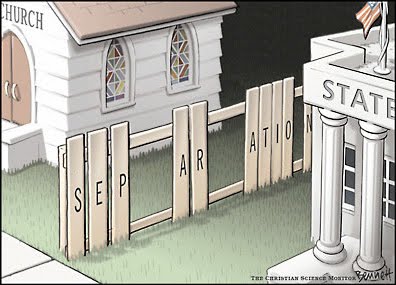

Political regulations have led to a fatal love triangle between States, commercial banks and the Central Bank. This marriage is harmful but they cannot be divorced. The origins of the crisis lie in the integration of two systems that should be independent of each other, namely, governments and banks.

Ideally, a state is free of debt, because the taxes paid to him and his expenses cover in height.  Bonds give the commercial banks in turn possibility to be used as collateral in order to refinance at the central bank. The child of this unhappy marriage is the systemic importance. Bankruptcies of banks threaten States of the States banks. The aim must be to dissolve the marriage, for it is ill fated, as the crisis shows.

Bonds give the commercial banks in turn possibility to be used as collateral in order to refinance at the central bank. The child of this unhappy marriage is the systemic importance. Bankruptcies of banks threaten States of the States banks. The aim must be to dissolve the marriage, for it is ill fated, as the crisis shows.

The starting point is the regulatory capital of commercial banks. The Solvency has created the fiction that government bonds are considered risk-free, as long as they are provided with an adequate rating. Government regulation itself has thus raised the rating agencies to the executioner on the banks’ balance sheets.

All attacks about unfair rating agencies must therefore be rejected. The rating agencies did not have this power. A first step must therefore be to abolish the regulatory rating, as said the chairperson of the Monopolies Commission, Professor Daniel in his interview room at 09.08.

Thus, the relevance of the judgements of rating agencies would be eliminated. The second step is relate to the regulatory zero weighting of sovereign bonds. It is not the job of politicians to require the valuation of assets.  The policy has created a special kind of systemic importance: All government bonds of an issuer are rated in all bank balances equal and for an individual scope is no room.

The policy has created a special kind of systemic importance: All government bonds of an issuer are rated in all bank balances equal and for an individual scope is no room.

Nevertheless, the best risk managers sit in the risk departments of banks, and not in political committees. This issue needs to be reviewed, which will make the system more stable, because there is less uniformity and more diversification. For the rating of sovereign bonds, there should be no special treatment. They should be evaluated in the future according to their actual credit risk.